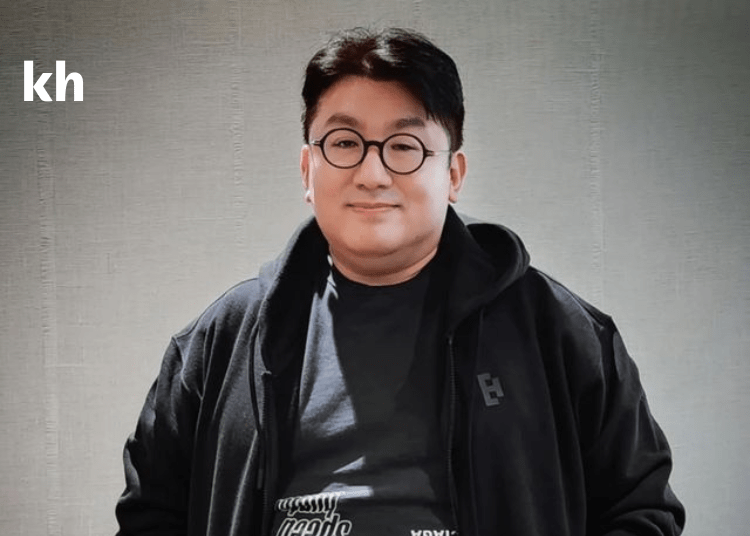

Bang Si-hyuk is accused of fraudulently selling HYBY shares worth 400 billion won and faces the possibility of life imprisonment.

The Financial Supervisory Service (FSS) plans to seek a judicial investigation into Bang Si-hyuk on suspicion of engaging in dishonest and fraudulent activities, according to a story published by the Korea Economic Daily on the 28th of the same month.

The FSS’s Second Investigation Department gathered circumstantial evidence, the report said, that Bang Si-hyuk had misled current investors in 2019 by claiming there was “no plan for an initial public offering” and persuading them to sell their shares to a private equity fund (PEF) set up by a Bang acquaintance.

This happened when HYBE was proceeding with its IPO, which included requesting a certain audit. Bang later agreed to a 30% profit-sharing plan with PEF in exchange for a settlement of almost 400 billion won. During the initial public offering (IPO), the securities registration statement did not reveal the shareholders’ agreement.

In accordance with the Capital Markets Act, the Financial Supervisory Service (FSS) determined that the activities during HYBE’s listing amounted to fraudulent and deceptive transactions. The FSS plans to notify the prosecution through expedited procedures. The identical matter is being looked into by the Seoul Metropolitan Police’s Financial Crimes Investigation Unit.

According to reports, the FSS gathered several pieces of evidence demonstrating that HYBE was actively working for its IPO at the time. As required for first public offerings (IPOs), HYBE hired Han Young Accounting as its approved auditor in November 2019. Companies must provide documentation indicating the IPO process is in progress, such as a lead underwriter agreement or board meeting minutes, when requesting a designated audit. But according to reports, HYBE gave conflicting information, telling financial authorities that it intended to go public while telling current investors that it had no intentions for an IPO.

Serious consequences are anticipated if Bang Si-hyuk’s illicit actions are verified. Violations that result in avoided gains or losses over 5 billion Korean won are punishable by life in jail or at least five years in prison, as stated in Article 443 of the Capital Markets Act.

Given the consequences and symbolic importance of HYBE in the capital market, financial regulators are reportedly preparing a harsh response.